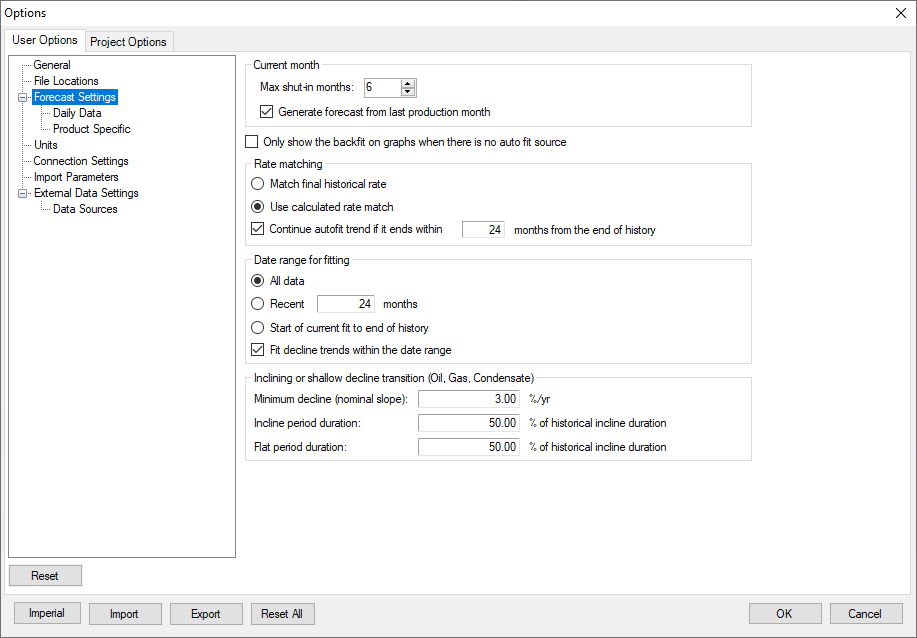

User Options: Forecast Settings

Click image to expand or minimize.

Max Shut-in Months

If the number of months between the last production date and the Current Month exceeds the number entered in max Shut In Months, the wells are considered shut in. Shut-in wells are not auto-forecasted on import and do not receive an economic case when economics are run. By Default, shut-in wells do not receive data copied to them from the Economic Input Copier.

Generate Forecast from Last Production Month

If this option is enabled, all wells in the project are forecasted from their last month of production. If this option is disabled, all wells are forecasted from the Current Month. If a well’s last month of production is prior to the project’s current month, but within the maximum shut-in months, there will be a gap between the last month of production and the start of the forecast.

This setting affects how the current month is set. See Set the Current Month.

Enabling this option is recommended when a project contains U.S. wells, where there is a large difference between each well’s last month of production.

Backfit

- Only show the backfit on graphs when there is no auto fit source: If enabled, the backfit is not displayed on wells that have an auto fit source. On wells with manual declines, the backfit will be displayed.

Date Range for Fitting

These options control how Value Navigator auto-forecasts wells.

- All data: Value Navigator automatically determines how much production history is needed to calculate a decline for each well.

- Recent: Value Navigator only goes back the entered number of months from the Set the Current Month and calculates a decline using that history.

- Start of current fit to end of history: The fit is based on data from the beginning of the current fit to the end of production history.

- Fit decline trends within the date range: When selected, Value Navigator looks for individual trends within the specified range. Trends are prioritized based on how recent they are and how much data they conform to.

Inclining or Shallow Decline Transition (Oil, Gas, Condensate)

These options limit the length of inclining or very shallow forecasts. Inclining forecasts and shallow forecasts (defined by the value entered in Minimum Decline) are limited to the number of months entered in Incline period duration and Flat period duration. After the duration, a new exponential decline segment is started at the rate entered in Default nominal slope. See User Options: Product Specific.

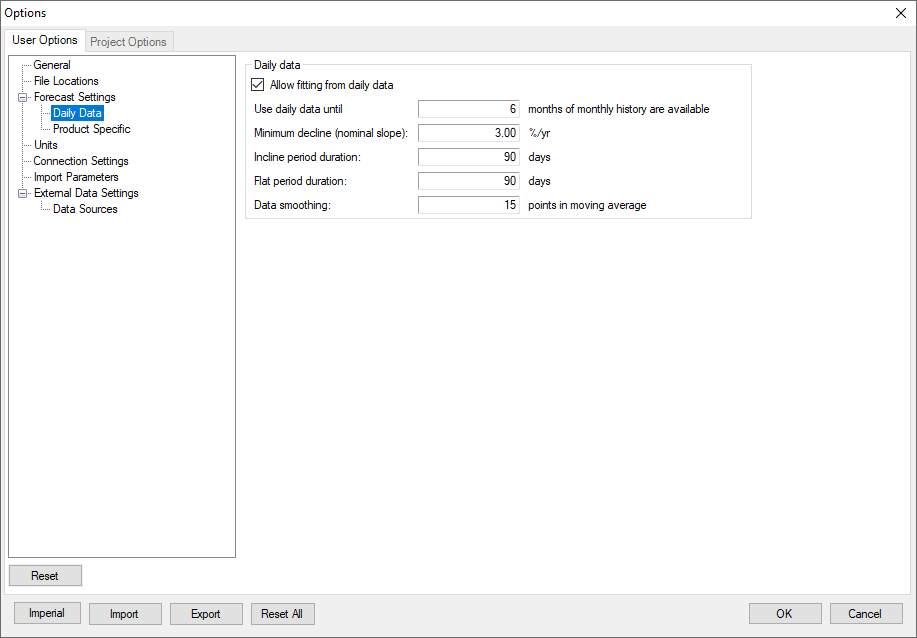

Daily Data

Click image to expand or minimize.

- Allow fitting from daily data: Enable or disable fitting for daily data

- Use daily data until: Sets the transition point at which monthly data is used in fitting instead of daily data.

For the rest of the options, see the Inclining or Shallow Decline Transition section, above.

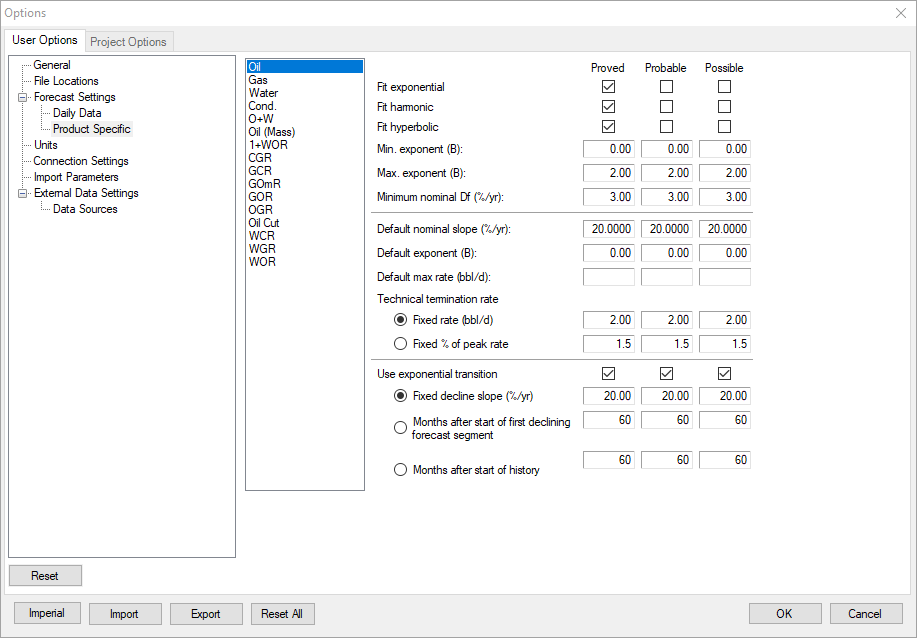

Product Specific

Click image to expand or minimize.

Value Navigator calculates an exponential, harmonic, and hyperbolic decline for oil, 1+WOR (inverse of oil cut), condensate, and gas. It then determines the average on-time, the maximum producing rates, and estimates the reserves associated with each of the possible decline types. A best fit is then produced.

Exponential, Hyperbolic, or Harmonic declines can be enabled or disabled with the check boxes. Enabling these decline types under PDP (Proved Developed Producing) or PPDP (Proved + Probable Developed Producing) generates a decline in those reserve categories.

The Min. and Max. Exponents specify the Ni range allowable for the hyperbolic decline. Specifying a maximum Ni of less than 1.0 prevents harmonic declines (Ni=1).

The Default parameters are used when inclining or shallow decline best fit slopes are created.

The Use exponential transition setting controls when hyperbolic or harmonic declines transition to an exponential decline.