Enter US Interests

Enter interests on Economics | Interests & Royalties.

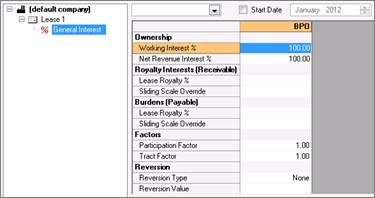

To select which interests are displayed, click the Interest Properties list at the top of the screen and select the interests from the list. Working Interest, and Net Revenue Interest are always displayed.

US ownership details

When you select a US entity and go to Economics | Interests &Royalties, two US-specific ownership interests are displayed:

- Lease Revenue Interest (LRI): The total amount of revenue interest available for the case. This is the Royalty Interest value for a 100% Working Interest and it is used in the calculation of the NRI value and the value of the Lessor Royalty Payable.

- Net Revenue Interest (NRI): The owner’s share in the Production and Revenue.

You can enter the NRI or it can be automatically calculated.

The NRI calculation:

NRI = WI * [(1-GORp)*(1-NORp)*(1-NPIp)] + (1-WI) * [1 - (1-GORr)*(1-NORr)*(1-NPIr)]

- Changing the WI recalculates the NRI, not the Royalty.

- If you enter a Sliding Scale override, a flat number for the NRI can no longer be determined so <Sliding Scale> is displayed.

Ownership and Payable/Receivable Grid Interaction

- Entering an LRI generates the equivalent Royalty value in the Burdens section

- Entering an NRI generates the equivalent Overriding Royalty value in the Burdens section

- Entering a Royalty % Burdens calculates the equivalent LRI

- Receivables are always considered in the NRI calculation on the Grid unless the WI is 0. Receivables are always considered in the final calculations on the output reports.

Entering Data in the Interests Grid

The following scenarios represent some of the different data entry methods available for the Interests grid.