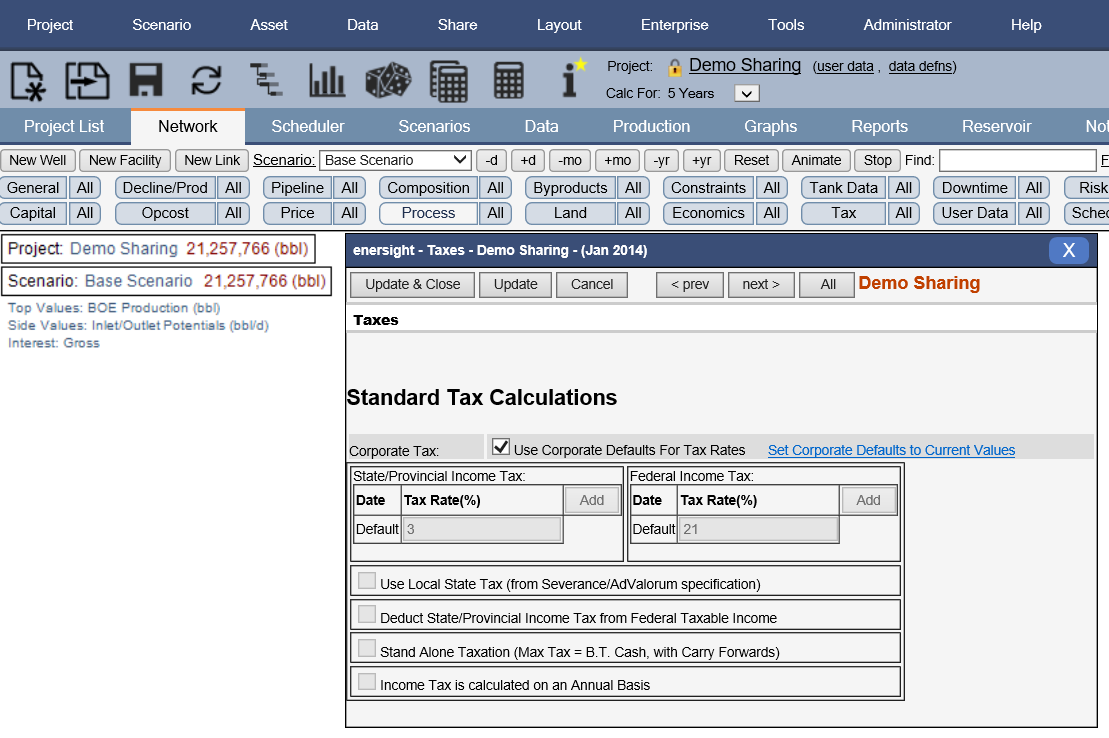

US Taxes

Introduction

The Tax dialog box is used to enter state/provincial and Federal Tax when the economic model includes Econ_USTaxes. The inputs of this dialog interact with the Severance and Ad Valorem inputs that maybe covered under Royalties / Economics / Sev & Ad Val dialog box as named by your company. Refer to Severance and Ad Valorem.

Click image to expand or minimize.

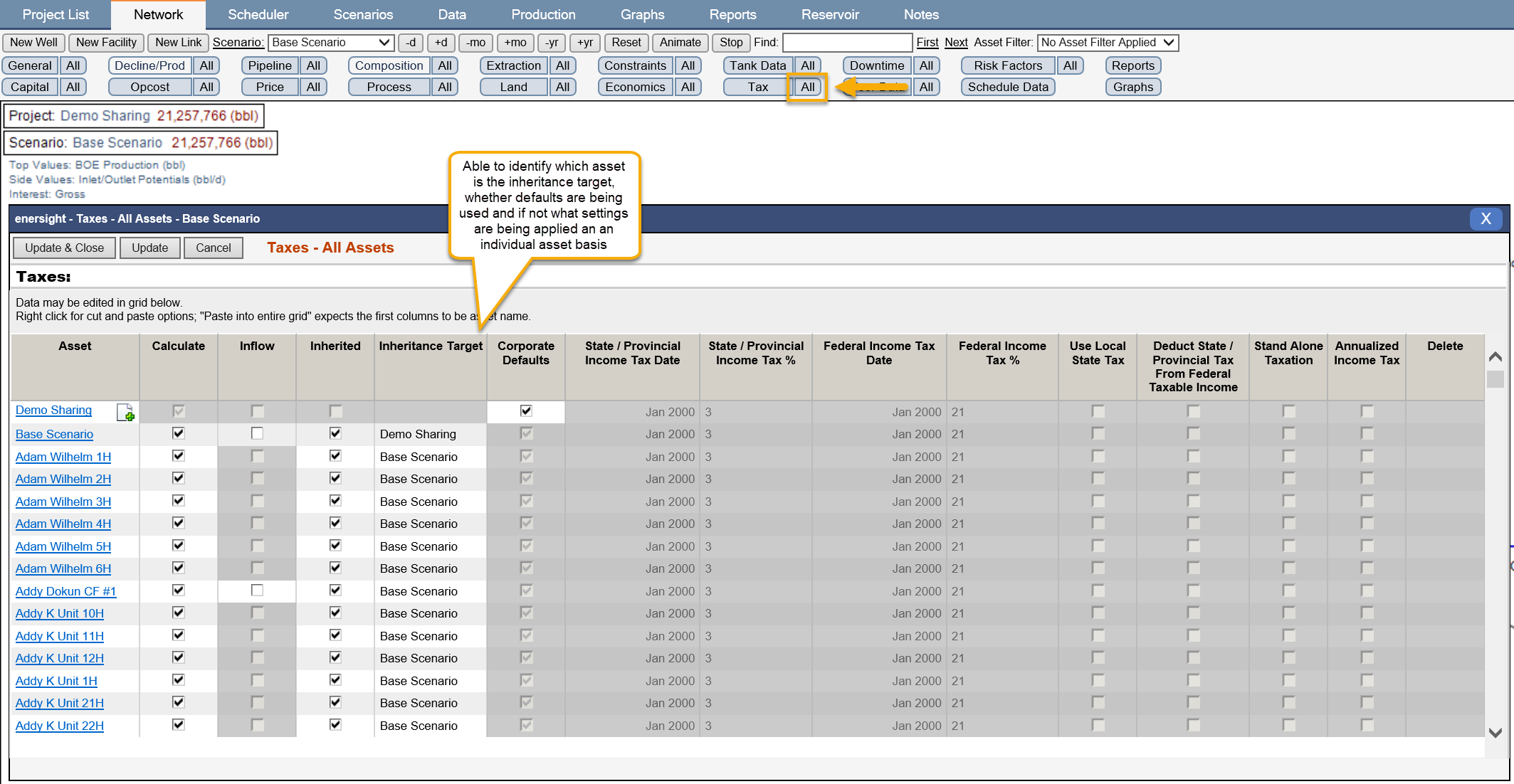

The full set of details may also be viewed via the All button whereby direct edits as well as copy/paste functionality is available.

Click image to expand or minimize.

Use Local State Tax

This check box is checked when you want to use the State Income Tax input from the severance/ad valorem table instead of the state/provincial income tax table.

Deduct State Tax from Federal Taxable Income

This check box is usually required for the US. Most state tax, including Severance and ad valorem taxes are deductible from federal taxable Income.

Stand Alone Taxation

This check box is checked when you want to carry forward tax losses. If it is NOT checked, then the model will calculate negative tax liabilities in periods where the deductions are greater than the revenues. This is a valid mode to run economics in when there are other projects with profits that the current project can offset losses against.

Income Tax is Calculated on an Annual Basis

This check box toggles between monthly and annual basis for income tax calculation.