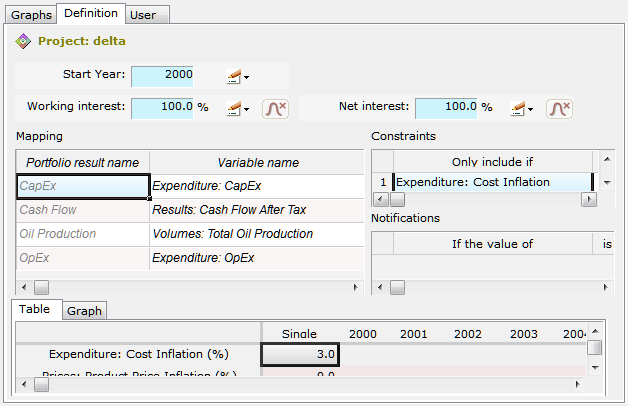

Definition Tab (Portfolio Project)

Use this tab to define the place of the currently selected project in the portfolio.

- Start Year: Use this option to shift the project's life span forward or backward in time.

- Working Interest: Enter the share of cash flow, as the percentage of the project-level results that will be included in the portfolio-level results. This affects CapEx, OpEx and production, unless Net Interest is activated in which case production is excluded.

- Net Interest: (Only when Net Interest is enabled from the root node Edit menu.) Enter the share on oil/gas production, as the percentage of the project-level results that will be included in the portfolio-level results.

The tab includes the following panes:

- Mapping: Select the economic result variables that correspond to the portfolio results (entered under Indicators in the root portfolio node). The economic results available in the drop-down are the ones Tagging Variables as Results in the economic model associated with this project in the Files Tab (Portfolio), and which match the unit type selected for the indicator.

- Constraints: This table contains the conditions under which the currently selected project will be excluded from the portfolio calculations. Right-click on the table to add or remove constraints. Projects excluded because of a constraint are marked in the Tree View with a

.

. - Notifications: This table contains the conditions under which notifications will be issued. Right-click on the table to add or remove notifications. Notifications are marked with

signs on the timeline of the Graphs Tab (Portfolio Project).

signs on the timeline of the Graphs Tab (Portfolio Project). - Table sub-tab: This table shows all the results as read from the econ results file, with values (single-type results in the first column, arrays in the rest).

- Graph sub-tab: This graph displays all array-type results on a timeline (see Simulation Graphs).

You cannot use a date-type variable as parameter for constraints or notifications.

Only single-type variables can be used for defining constraints, since for including a project/portfolio in a portfolio project a yes/no condition is necessary. On the other hand, both single- and array-type variables can be used for triggering notifications.

When you use the option to Save indicators as default in the Definition Tab (Portfolio), PetroVR also records which indicators are mapped to econ variables with identical names in all projects currently in the portfolio, and saves this mapping. When new projects are added to the portfolio, the application automatically associates these indicators, provided the variable names are identical.

Are the project results that I use in the portfolio calculations deterministic or mean values?